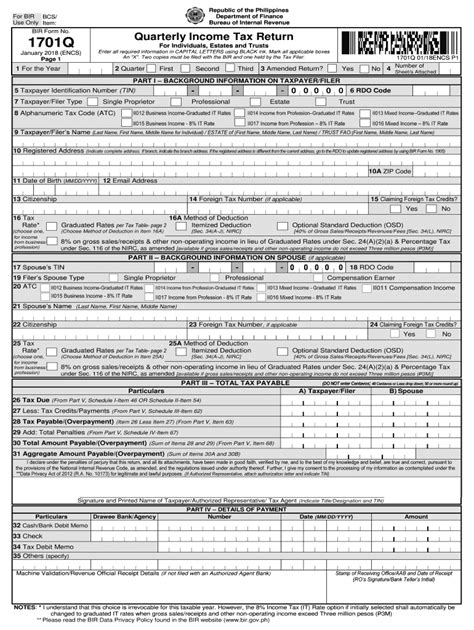

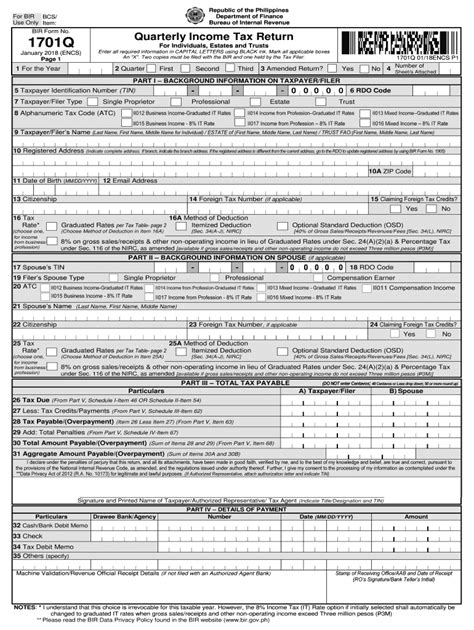

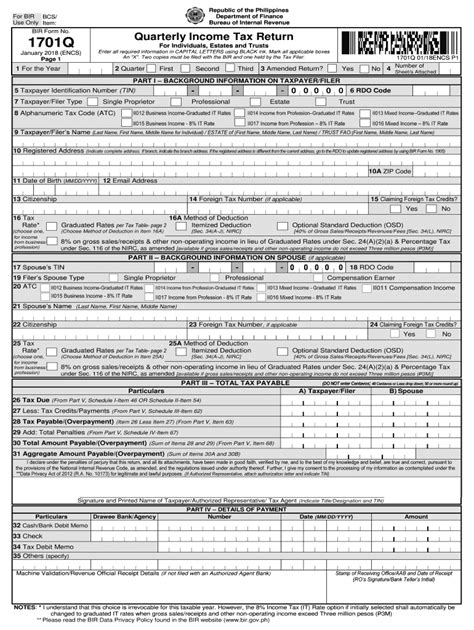

bir form 1701q download|DLN: Taxpayer PSOC: PSIC: Spouse PSOC: PSIC: Quarterly : Pilipinas Download the latest version of BIR Form No. 1701Q for individuals, estates and trusts. Fill in the form with your income, deductions, credits, penalties and tax rates for the quarter. Explore MBTI personality type of The Fairly OddParents (2001) characters, casts and creators ( •ᴗ• ) 👉

bir form 1701q download,Download the official form for individuals, estates and trusts to file their quarterly income tax return with the Bureau of Internal Revenue (BIR) in the Philippines. The form contains .

BIR Form No. 1701Q July 2008(ENCS) For Self-Employed Individuals, Estates, and .The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a .Download the official form for self-employed individuals, estates, and trusts to report their income and pay taxes for the quarter. Fill out the form with your TIN, RDO code, name, .Download the latest version of BIR Form No. 1701Q for individuals, estates and trusts. Fill in the form with your income, deductions, credits, penalties and tax rates for the quarter.The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated .BIR Form 1701Q, also known as Quarterly Income Tax Return For Self-Employed Individuals, Estates and Trusts (Including those with both Business and Compensation Income) is a tax return intended for .Download and fill out BIR Form 1701Q, a tax form for individuals engaged in trade, business or profession in the Philippines. Learn who should file, when and where to file and pay, .

bir form 1701q downloadDownload the PDF file of BIR Form 1701Q, the quarterly income tax return for self-employed, professionals, estates, and trusts. Fill in the form with your personal and . Guide and Tutorials on How to File and Submit BIR Form 1701Q or the Quarterly Income Tax Return For Individuals, Estates and Trusts using eBIRForms 7.7Guidelines and Instructions for BIR Form No. 1701Q [January 2018 (ENCS)] Quarterly Income Tax Return for Individuals, Estates and Trusts . Who Shall File. This return shall .

The BIR Form 1701Q, also known as the Quarterly Income Tax Return is a tax form for taxpayers in the Philippines who earn income from business operations, practice of .The Off-Line Method allows you to download the tax form into a directory of your choosing, thus saving it into your hard drive. This allows you to fill out the form at your own convenience without having to stay connected onto the Internet. You may use the PDF Format or the Stand-alone Offline Form found in the eFPS Home Page.

Annual Income Tax Return Page 5 - Schedules 1 to 4A BIR Form No. 1701 June 2013 (ENCS) 170106/13ENCSP5 TIN Tax Filer’s Last Name 0 0 0 0 SCHEDULES-REGULAR RATE Schedule 1 - Gross Compensation Income and Tax Withheld (Attach additional sheet/s, if necessary) Gross Compensation Income and Tax Withheld (On Items 1, 2 & .What is BIR Form 1701Q? BIR Form 1701Q is a Quarterly Income Tax Return for Individuals, Estate and Trusts. It is mandatory to be filed every first to third quarter of each year, regardless of if with or without income or operation, as long as you are actively registered in BIR as Individual Taxpayer engaged in business, self-employment, .

How to Fill Out BIR Form 1701Q PDF. Filling out the form may seem complex, but with a systematic approach, it becomes more achievable. Follow these 7 important steps to complete the form effectively: Make the most of the BIR 1701Q form download option for offline completion, or complete the form online via PDFLiner.Do whatever you want with a 2551q BIR formTaxation In The United StatesIncome Tax: fill, sign, print and send online instantly. Securely download your document with other editable templates, any time, with PDFfiller. No paper. No software installation. On any device & OS. Complete a blank sample electronically to save yourself time and money. TryDLN: Taxpayer PSOC: PSIC: Spouse PSOC: PSIC: Quarterly 1.Certificate of Income Payments not Subject to Withholding Tax (BIR Form 2304), if applicable; 2.Certificate of Creditable Tax Withheld at Source (BIR Form 2307), if applicable; 3. Duly Approved Tax Debit Memo, if applicable. The quarterly income tax return does not have to be accompanied with Account Information Form and/or Financial .

final return (BIR Form No. 1701), and the income for business/profession is also subject to the tax rates as discussed in the first paragraph of this item (Tax Rate). In this case, if qualified, the 8% option if selected, the same is based on gross sales/receipts and other non-operating income and the P250,000 reduction is no longer applicable. BIR Form 1701 - Annual Income Tax Return Guidelines and Instructions : Who Shall File. This return shall be filed in triplicate by the following individuals regardless of amount of gross income: 1) A resident citizen engaged in trade, business, or practice of profession within and without the Philippines. .

Edit Bir form 1701q download. Quickly add and underline text, insert pictures, checkmarks, and signs, drop new fillable fields, and rearrange or delete pages from your paperwork. Get the Bir form 1701q download accomplished. Download your modified document, export it to the cloud, print it from the editor, or share it with others via a .Get the latest version of Bir 1701Q Form • Edit, fill out, and send online • Massive database of various templates and PDFs. BIR 1701Q Form – Fill Out and Use This PDF. Business . . press "Done" and you are all set! Make a free trial plan at FormsPal and gain direct access to 1701q bir form - download, email, or change from your .

Are you required to file BIR Form No. 1701 but don't know how? Watch this video for a step-by-step guide on how to fill up and file your BIR Form No. 1701 online using eBIRForms!

BIR Form 1701 PDF Download. If you need an editable PDF file for this BIR form, you can it in this link BIR Form 1701 Editable PDF. Completing a BIR form is a daunting task that is why we built a software to automate this and weve been using it since 2012. You can also use this tool for your taxes to save time and so you can focus on more .

BIR Form 1701, also known as Annual Income Tax Return for Self-Employed Individuals, . Download App; Value Added Tax; Form 2550M; Form 2550Q; Withholding Tax; Form 1601-FQ; Form 1604-E; Form .

Bir form 1701q download. Get the up-to-date 1701q 2024 now Get Form. 4.8 out of 5. 157 votes. DocHub Reviews. 44 reviews. DocHub Reviews. 23 ratings. 15,005. 10,000,000+ 303. 100,000+ users . Here's how it works. 01. Edit your bir form 1701q download online. Type text, add images, blackout confidential details, add comments, highlights and more.

DOWNLOADS Offline eBIRForms Package with Annual Income Tax Returns v2013 ENCS (Latest Version) BF1702-SupplementalForm Page1 (November 2011ENCS version) eFPS Offline FormClick on New Document and select the form importing option: add Bir form 1701 download from your device, the cloud, or a protected link. Make adjustments to the template. Utilize the top and left panel tools to change Bir form 1701 download. Insert and customize text, images, and fillable areas, whiteout unneeded details, highlight the .

bir form 1701q download DLN: Taxpayer PSOC: PSIC: Spouse PSOC: PSIC: Quarterly bir form 1701 download. 63C/D/E/F/G/H Regular Allowable Itemized incurred during the taxable year. This is the total amount reflected in the Mandatory Attachment to BIR Form No. Fill Now. 2551q form.

Download BIR Form 1701, also called "Annual Income Tax Return For Individuals (including MIXED Income Earner), Estates and Trusts" from the BIR website. Fill out Form 1701, following BIR's guidelines. Be careful and .

bir form 1701q download|DLN: Taxpayer PSOC: PSIC: Spouse PSOC: PSIC: Quarterly

PH0 · Quarterly Income 1701Q Kawanihan ng Rentas Internas Tax

PH1 · How to File and Submit BIR Form 1701Q using eBIRForms 7.7

PH2 · Guidelines and Instructions for BIR Form No. 1701Q [January

PH3 · Form 1701Q

PH4 · File 1701Q BIR Form

PH5 · DLN: Taxpayer PSOC: PSIC: Spouse PSOC: PSIC: Quarterly

PH6 · Bureau of Internal Revenue

PH7 · BIR Form No. 1701Q

PH8 · BIR Form No. 1701